✔️HRD Corp SBL-Khas Claimable

✅FREE Training E-Book

🔔Post-Training Support Group (1 Month)

☑️Practical Guide to E-Filling

🎓E-Certificate of Completion

💎Kelas Dwibahasa (English + BM)

🔥FEB 2026 - Only 1 Class!

Coach Zye's Training Photos

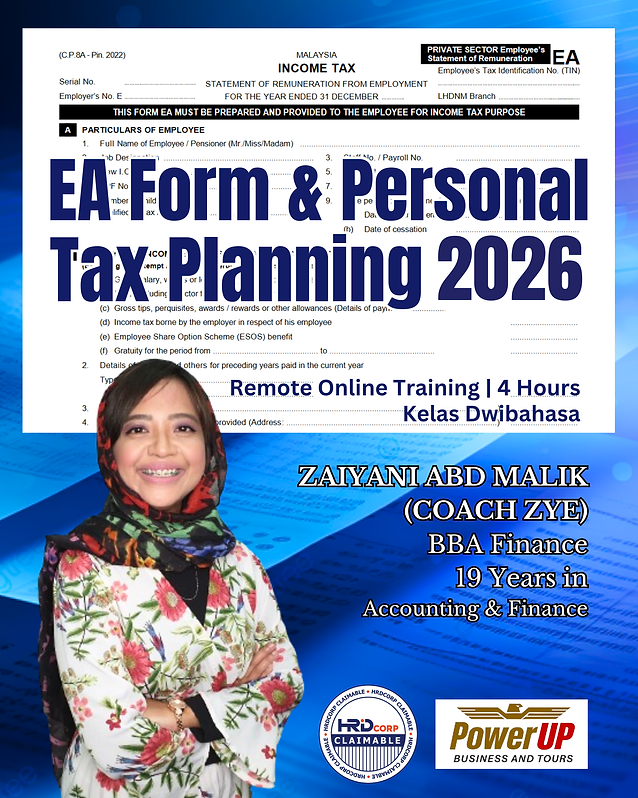

EA Form & Personal Tax Planning 2026

⚠️Employer Deadline of EA Form to Employee: 28th FEBRUARY 2026

⚠️Fine up to RM20,000, or jail sentence of up to 6 months, or both for failure to do so.

Who should attend?

- Executives & Management Team

- HR /Payroll /Account /Finance Personnel

- All Working Adults Submitting Their EA Form /E-Filling

.

Program Objectives:

The following skills will be acquired in this program:

- Defining & recognizing EA Form as a tax submission tool required by tax authority

- Understanding & discussing every element of EA Form

- Identifying & calculating the figures for every aspect of EA Form

- Discussing do’s & don’ts while preparing EA Form

- Preparing EA form accurately

- Identifying & understanding E-Filing as personal tax filing platform

- Understanding & discussing every aspect of BE Form

- Recognizing and extracting the accurate figure from EA form to BE Form

- Discussing do’s & don’ts while preparing BE Form

- Drafting & preparing BE form accurately

- Submitting BE form accurately

.

Trainer: Zaiyani, also known as Coach Zye, has more than 19 years of experience in managing full sets of accounts & tax matters in various industries such as oil & gas, manufacturing, trading, logistics and others. She is a HRDC & NCS Certified Trainer who hold Bachelor's Degree in Finance from UiTM, and spent many years in managerial posts preparing financial report and statement.

As an entrepreneur herself, she is also eager to share her industry expertise through training and development programs to help the community. Her other roles such as Treasurer and Board Member in few Koperasi and NGOs, as well as Treasurer of Thames Oxford Academy NCS Alumni.

.

Program details:

💎Date : 7th FEBRUARY 2026 (SATURDAY) - Only 1 Class!

💎Time : 9.00am – 1.00pm

💎Duration : 4 hours

💎Location : Remote Online Training (Zoom💻)

💎No. of pax : Limited 30 pax only (First come first serve🔥)

💎Language : Dwibahasa (English + Bahasa Malaysia)

🎓Certificate: E-Certificate of Completion

** HRD Corp Training Program No.: 10001465433

--

Original price: RM650/- per pax

NOW 👉Special price: RM350 + 8% SST = RM378/- only

Invoice to company /Direct debit /Credit card /E-Wallet /HRD Corp Claimable✅

*Price inclusive of E-Book & E-Certificate of Completion

*Payment method will be informed upon registration submitted

--

Course Modules:

📌Introduction to EA Form

-

Understanding the EA Form

-

Purpose of EA Form

-

How to use EA form in your organization

-

Who should use/prepare EA Form

-

Date submission EA Filing

📌The Elements of EA Form

-

Particulars of Employee

-

Employment Income & Benefits

-

Pension & Others

-

Total Deduction

-

Contribution paid by Employees

-

Total Tax-Exempt Allowances

📌Do’s & Don’ts while preparing EA Form

📌Preparing EA Form

-

Determining all sources of income, deduction etc to conclude the right amount for every element of EA Form

-

Extracting information from Payroll Report

-

Calculating the collective amount

-

Reporting the amount to EA Form

📌Endorsement

-

Who is eligible to endorse the EA Form

-

When should EA form be prepared and released

📌Introduction to E-Filing

-

Understanding the E-Filing

-

Purpose of E-Filing

-

How to use E-Filing

-

Who should use/prepare E-Filing

-

Date submission E-Filing

-

Registration

-

Eligible Residency for non-Malaysian/PR

-

Income Declaration, Submission & Payment

-

Taxable Income

-

Tax Relief & Tax Rebate

-

Type of Declaration (Self/Spouse)

-

Tax Rate

📌The Elements of E-Filing

-

Particulars of Individual

-

Statutory Income & Total Income

-

Donation/Gift/Sponsorship

-

Relief

-

Tax Summary

-

Other Info

-

Submission

📌Do’s & Don’ts while preparing E-Filing

📌Preparing E-Filing

-

Determining all sources of income, deduction etc to conclude the right amount for every element of E-Filing

-

Extracting information from EA Form

-

Calculating the collective amount

-

Reporting the amount to E-Filing

-

E-Filing Draft Submission

-

E-Filing Final Submission

.

.

✔️HRD Corp SBL-Khas Claimable

✅FREE Training E-Book

🔔Post Training Support Group (1 Month)

☑️Practical Guide to E-Filling

🎓E-Certificate of Completion

🔥Limited Seats only

📞Enquiry : Feel free to WhatsApp - Loki

https://wa.me/60172259937

*Kindly fill up details required as below & click 'Submit' button to reserve your seat

*We will add you directly into participants' WhatsApp group

.png)